Your cart is currently empty!

Maximizing Your Property Claim: Strategies to Secure 20% or More from Your Insurance Company.

Are you frustrated after a car accident leaves your vehicle totaled? Disappointed with the insurance company’s offer for your car damage? Struggling with negotiation skills and finding it difficult to secure fair compensation? If you’re nodding along, feeling like your used car isn’t getting the value it deserves, then I have the solution for you.

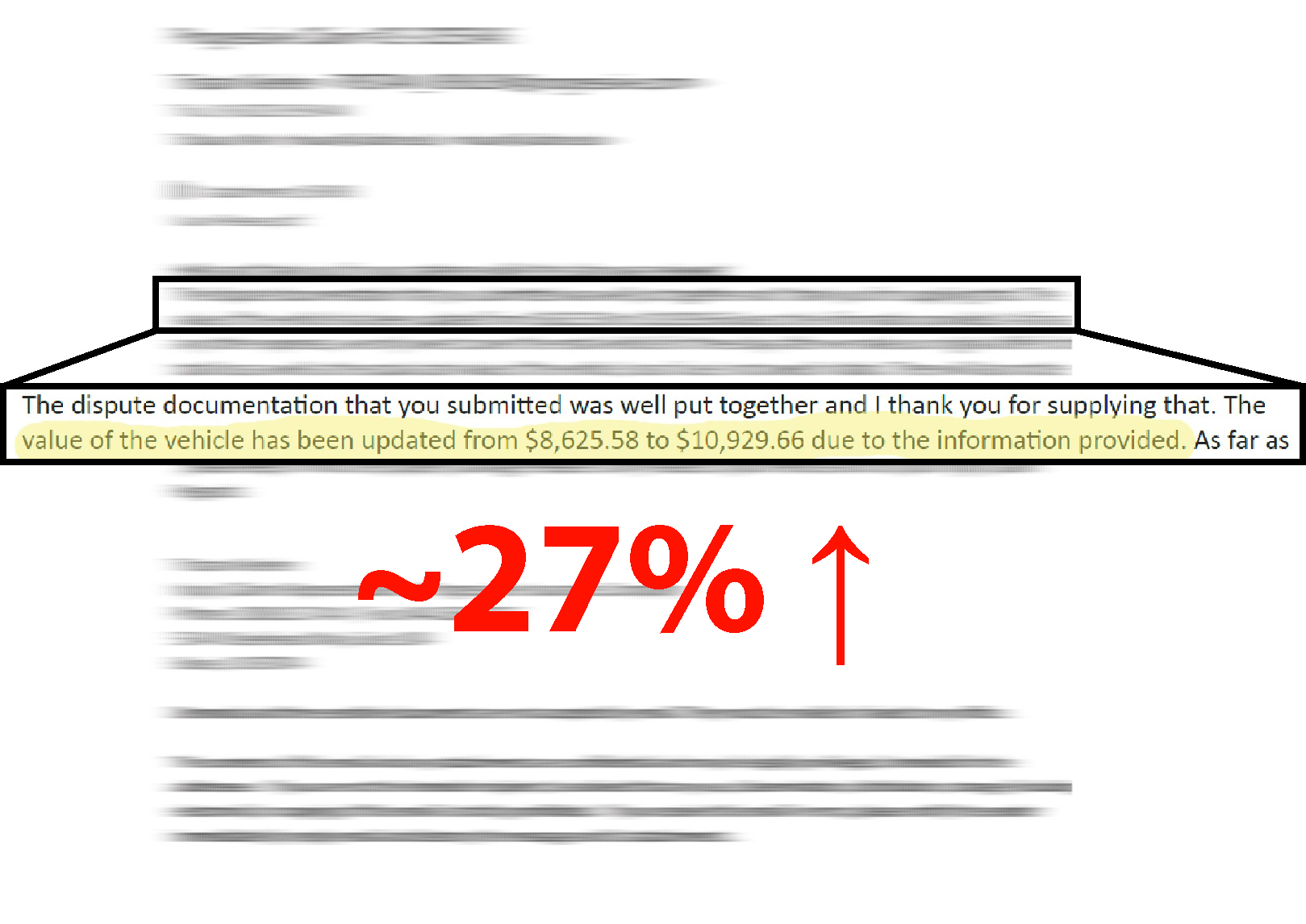

Introducing our DO-IT-YOURSELF kit designed to maximize your insurance compensation by at least 20%! Picture this: the insurance company offers you $8000, but with our kit, you could boost that to $10,000 or even $11,000. Why settle for less when your car is worth more?

Don’t let the insurance company undervalue your vehicle. Take control of your compensation today with our proven kit. Get the payout you deserve!

My Story

In January 2023, I experienced a car accident that left me shaken. The impact came from the driver’s side, where my toddler was seated behind me. Thankfully, both of us emerged physically unharmed, though the emotional shock lingered.

Following the accident, the insurance company representing the at-fault driver reached out to gather more details. They assured me of a temporary car rental until their investigation concluded and they could provide a compensation offer for my vehicle. Typically, this process takes about two weeks, factoring in the time required for the police report, which usually takes around 10 days to finalize.

When the initial offer of $8600 arrived, it initially seemed reasonable. However, upon conducting my own research and comparing prices for vehicles with similar features, I discovered that similar cars were priced significantly higher, ranging from $13,000 to $14,000. It became evident that the insurance company was offering me far less than the fair market value.

This experience taught me a valuable lesson: never accept the first offer without questioning it. Insurance companies often anticipate negotiation and leave room for adjustments.

Usually, it’s easy to find a lawyer for injuries because they can make a lot of money from those cases. But when it comes to getting money for damage to your belongings, lawyers aren’t as interested. They know it’s a lot of work for not much pay.

If you’re not confident in negotiating with insurance companies and you feel they’re not offering you enough money, I have a simple solution: a guide called DO-IT-YOURSELF. It shows you how to prove to the insurance company that their offer isn’t fair.

My Service

After you read the guide and find yourself short on time or needing some help, you can use our service. We’re here to assist!

Contact us!

Unable to download? Any other questions? Please contact us.

Secure Payment

100% security guaranteed

24/7 Support

Online, phone and email support

Free Shipping

Immediate download